Top Payroll Outsourcing Providers in India

Introduction of Payroll Outsourcing in India

Over the past decade, Payroll Outsourcing in India has evolved from a simple salary calculation service to a complete end-to-end payroll management solution — encompassing statutory compliance, employee benefits, tax management, and automation through cloud-based systems.

With the growing focus on efficiency, accuracy, and compliance, payroll outsourcing has emerged as a strategic choice that not only saves time but also enhances workforce satisfaction.

What Is Payroll Outsourcing Services?

Payroll Outsourcing Services refers to the practice of hiring an external service provider to manage all payroll-related processes, including salary computation, tax deduction, statutory compliance, and employee benefit management.

Instead of maintaining an in-house payroll team, businesses collaborate with professional payroll outsourcing providers who handle:

Employee salary processing and payslip generation

Provident Fund (PF), ESI, and TDS compliance

Attendance and leave data integration

Reimbursements, bonuses, and deductions

End-of-year tax reports and Form 16 generation

Essentially, payroll outsourcing helps organizations focus on their core business activities while experts take care of compliance and accuracy.

Why Businesses in India Are Choosing Payroll Outsourcing

India’s dynamic regulatory environment makes payroll processing complex and time-consuming. Frequent changes in tax laws, employee benefits, and labour compliance create challenges for HR teams.

Here are some key reasons -

Compliance Simplified Outsourcing ensures timely compliance with EPF, ESI, TDS, and other statutory regulations.

Cost-Effective Operations Companies save on hiring payroll staff, maintaining software, and training resources.

Accuracy and Timeliness Experts use advanced systems to eliminate human errors and ensure timely salary disbursal.

Scalability Payroll providers can easily handle workforce expansion or reduction without internal restructuring.

Focus on Core Business HR teams can shift their attention from administrative work to employee engagement and growth.

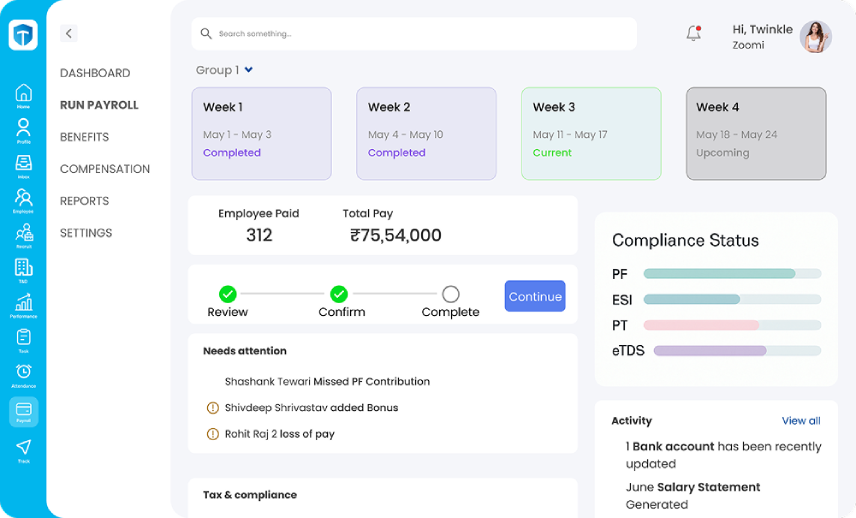

Key Features of Best Payroll Outsourcing Providers in India

When choosing the best payroll outsourcing services, look for providers that offer comprehensive solutions with a blend of automation, security, and support.

Here are the key features leading providers typically offer:

Automated Salary Calculations Ensures error-free and fast salary processing based on attendance and performance data.

Compliance Management Covers PF, ESI, PT, and other statutory contributions.

Data Security Encrypted and GDPR-compliant systems for protecting sensitive employee data.

Employee Self-Service Portals Allows employees to download payslips, view leave balances, and update information.

Cloud-Based Access Real-time payroll data accessible from anywhere.

Tax and Reimbursement Management Simplifies income tax deductions and reimbursements.

Custom Reporting Advanced analytics and payroll summaries for management insights.

These features not only streamline HR processes but also ensure transparency, compliance, and employee satisfaction.

Top Payroll Outsourcing Providers in India

Here’s a curated list of Top Payroll Outsourcing Providers in India for 2025–26, known for reliability, advanced technology, and customer satisfaction

1. TankhaPay

Best For MSMEs and workforce compliance.

Highlights TankhaPay simplifies payroll and compliance for employers with distributed or contractual workers. It automates salary payments, benefits, and statutory filings under a single platform — ensuring employees receive social security benefits.

2. Keka Payroll

Best For Startups and growing businesses.

Highlights Known for its user-friendly interface and automation tools, Keka integrates payroll with performance and attendance systems for complete HR control.

3. GreytHR

Best For Mid-sized organizations.

Highlights Offers cloud-based payroll processing, leave management, and compliance tracking with robust automation.

4. Zoho Payroll

Best For Businesses using Zoho ecosystem.

Highlights Simplifies payroll and compliance with direct integration into Zoho Books and HR modules.

5. RazorpayX Payroll

Best For Fintech-driven organizations.

Highlights Combines payroll and payments with direct bank integration and automated compliance filing.

6. HROne

Best For Large enterprises and corporates.

Highlights Provides a complete HR suite with employee lifecycle management, payroll automation, and advanced reporting tools.

7. Pocket HRMS

Best For SMEs and startups.

Highlights Cloud-based platform with mobile access, attendance tracking, and payroll insights.

8. PeopleApex

Best For Enterprise-level payroll operations.

Highlights Offers global payroll management with compliance automation and scalable architecture.

9. Zimyo

Best For: Small to medium businesses seeking affordability.

Highlights: Simplifies HR, payroll, and compliance with easy onboarding and strong customer support.

10. ADP India

Best For: Multinational corporations.

Highlights: Offers global-standard payroll outsourcing with AI-driven analytics, compliance, and workforce management.

Pricing Overview of Payroll Outsourcing Services in India

Pricing for payroll outsourcing in India depends on several factors — including company size, number of employees, frequency of payroll runs, and compliance requirements.

Here’s an approximate breakdown

Small Businesses (1–50 employees) ₹40–₹100 per employee per month

Medium Enterprises (51–500 employees) ₹30–₹75 per employee per month

Large Organizations (500+ employees) Customized pricing based on complexity

Some providers also offer subscription-based models or bundled HR + payroll services, which can further reduce costs.

Benefits of Payroll Outsourcing for Indian Businesses

Here are the top benefits that make payroll outsourcing an essential HR strategy in 2025

Time Efficiency Frees HR teams from manual processing.

Cost Reduction Eliminates infrastructure and software costs.

Regulatory Compliance Ensures timely statutory submissions.

Improved Accuracy Minimizes calculation and reporting errors.

Employee Satisfaction Ensures on-time salary payments and transparency.

Access to Expertise Professional payroll teams stay updated with government policies.

Scalable Solutions Adaptable for growing business needs.

Data Security Providers use advanced encryption and access control.

Comprehensive Reports Offers detailed payroll analytics for management.

Enhanced Productivity Allows focus on core HR and business goals.

How to Choose the Right Payroll Outsourcing Service Partner

Selecting the best payroll outsourcing service in India requires careful evaluation. Here are essential factors to consider

Experience and Reputation Choose vendors with proven expertise in payroll management.

Technology Stack Ensure they use advanced, secure, and scalable payroll systems.

Compliance Knowledge Providers should have deep understanding of Indian labour laws.

Customer Support Check for 24/7 support and dedicated account managers.

Data Security Must follow GDPR and ISO standards.

Customization Options Ability to adapt services to your company’s policies.

Transparent Pricing No hidden charges; clear SLA agreements.

Choosing a reliable partner ensures accuracy, compliance, and peace of mind.

Challenges in Payroll Outsourcing and How to Overcome Them

While payroll outsourcing offers numerous advantages, businesses may face some challenges, such as:

Data Privacy Concerns

Solution Partner with ISO-certified providers with secure data encryption and limited access controls.

Dependency on Vendors

Solution Maintain internal control over payroll data and periodic audits.

Communication Gaps

Solution Establish clear SLAs and regular performance reviews.

Customization Issues

Solution Choose flexible providers offering modular services.

With the right strategy and vendor, these challenges can be minimized for seamless payroll management.

Conclusion

As we move into 2025 and beyond, Payroll Outsourcing Services in India will continue to grow rapidly — driven by automation, AI integration, and the need for cost-effective compliance management.

Businesses across industries are realizing that payroll outsourcing isn’t just about delegating tasks — it’s about creating a smarter, compliant, and efficient HR ecosystem. Whether you’re a startup or an enterprise, choosing the best payroll outsourcing provider can streamline your operations, reduce compliance risks, and boost employee trust.

Comments

Post a Comment